Will vs. Living Trust in Utah What to choose and why

Plain-English guide to how wills and living trusts work in Utah, including probate, privacy, costs, funding, and a simple decision checklist

Utah Law Explained makes estate planning practical for Utah families. If you want control over what happens to your assets, you will hear two terms a lot: will and living trust. They are both valid tools but they work very differently.

This page explains how each tool works under Utah law, how they affect probate, privacy, costs, and day to day management, and gives you a clear checklist to help you choose with confidence.

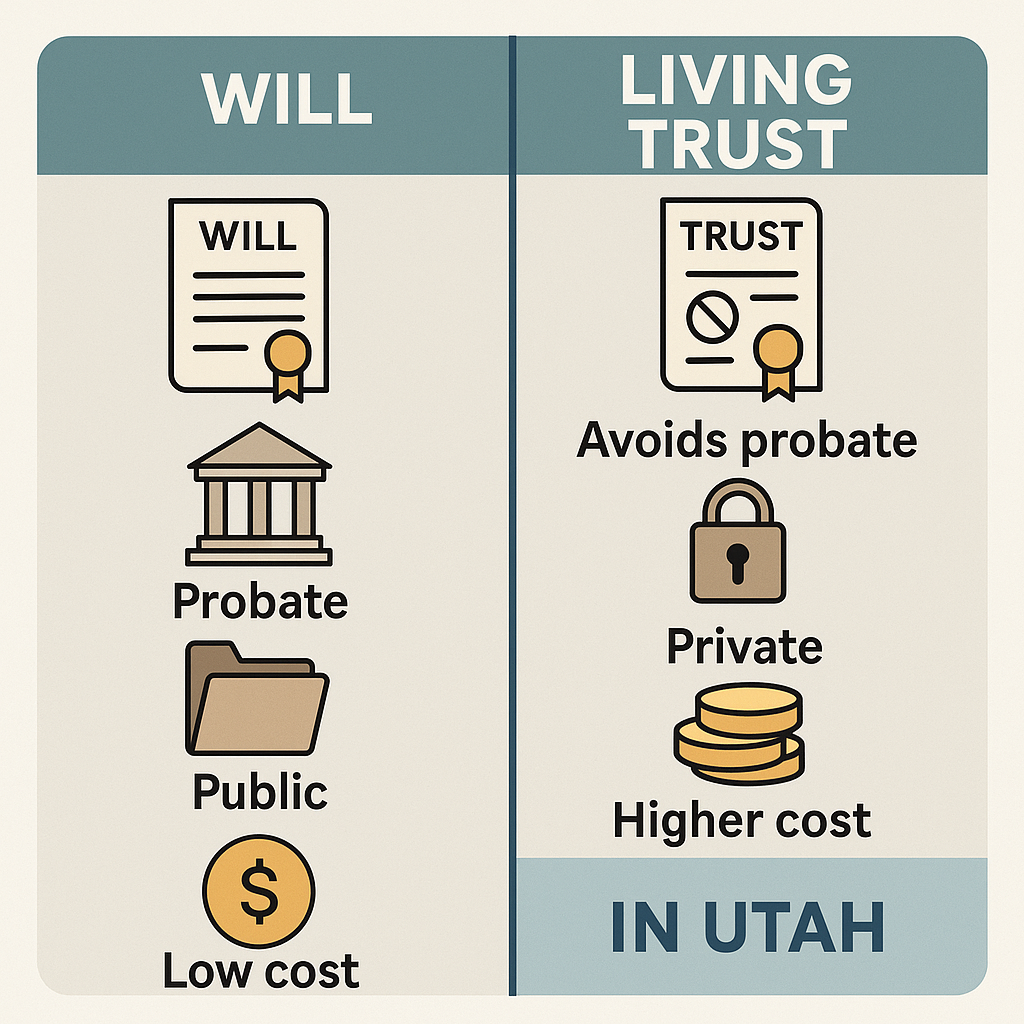

Will vs. Living Trust — The Basics

Here is how the two options compare in plain English.

What a Will Does

A will is a written document that directs who gets your property after death. It takes effect only after you die and it goes through Utah probate court.

What a Trust Does

A living trust is a legal entity you set up now. You place assets in the trust and name beneficiaries. A funded trust often passes assets outside probate.

Probate and Privacy

Wills are filed with the court and become public. A properly funded trust is handled in private by a successor trustee with no court file.

Cost and Effort

Wills are cheaper up front but heirs face probate costs and delays. Trusts cost more to set up and fund but can save time and fees later.

Control and Incapacity

Wills do not help during life. Trusts can name a backup trustee to manage assets if you become unable to do so.

Feature Comparison

Many Utah plans use both: a living trust for major assets plus a simple will to catch anything missed.

Funding a Living Trust

What Funding Means

Utah Funding Checklist

Costs and Complexity

Common Myths

Only the wealthy need a trust

Middle income families benefit too, especially to avoid probate and keep things private.

A will avoids probate

In Utah, wills are filed with the court. A funded trust is the tool that can avoid probate.

Trusts are too hard to manage

Once funded, they are straightforward. The key is to keep titles and beneficiaries current.

You must choose only one

Most Utah plans use both. Trust for major assets and a will as a safety net.

Decision Checklist

List Your Assets

Homes, land, bank accounts, investments, business interests, insurance, retirement.

Set Goals

Do you want privacy, speed, and fewer court steps for your heirs. If yes, lean trust.

Match Tool to Estate

Simple estate or early stage family. A will plus good beneficiary designations may be enough.

Plan for Incapacity

Trusts can name a successor trustee. With will only, add powers of attorney for finances and health care.

Fund or Update

If you choose a trust, retitle assets now. If you choose a will, confirm all beneficiaries and pay on death designations.

Utah Video Hub — Wills and Trusts

YouTube Resources

Instagram Highlights

Key Takeaways

Wills are cheaper up front but go through Utah probate and become public.

Living trusts need funding now but often avoid probate and keep details private.

Many Utah families use both. Trust for major assets, will as a safety net.

This page is legal information, not legal advice. When in doubt, talk with a Utah estate planning attorney.

Need Help Choosing

Unsure which path fits your goals. A short consult can help you avoid mistakes and set up the right mix for your family.

Talk to a Utah AttorneyWe can discuss your assets, privacy goals, probate concerns, funding steps, and how to keep your plan current.