Who Gets My Property in Utah If I Die Without a Will?

Plain-English guide to Utah intestacy laws, examples, and inheritance flowcharts

If you pass away in Utah without a will, state “intestacy” laws decide who inherits your property. The law follows a clear priority list, starting with your spouse and children, then moving outward to parents, siblings, and other relatives. This guide explains the rules in plain English, using simple family examples and visual diagrams so you can understand exactly who gets what.

Understanding Utah Intestacy

When someone dies without a will, Utah’s intestate succession law (Utah Code §75-2-101 through §75-2-114) steps in. It divides your assets among your closest living relatives in a fixed order. You can’t change that order unless you’ve made a valid will, trust, or other estate plan.

Think of intestacy like a family tree chart, starting with you at the top, then branching out to your spouse, children, and beyond.

If You’re Married

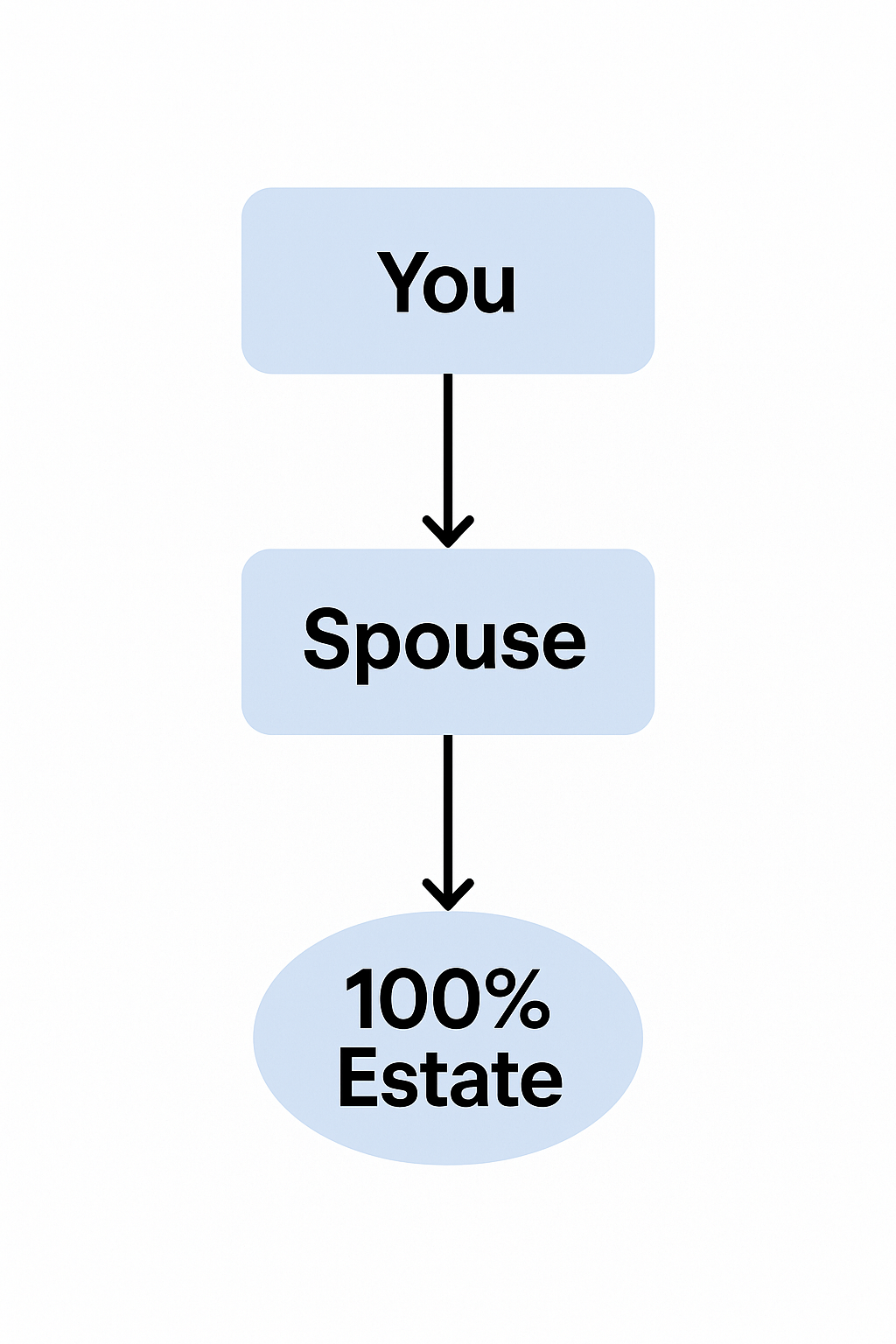

With children from the same spouse:

Your surviving spouse inherits everything.

Example diagram:

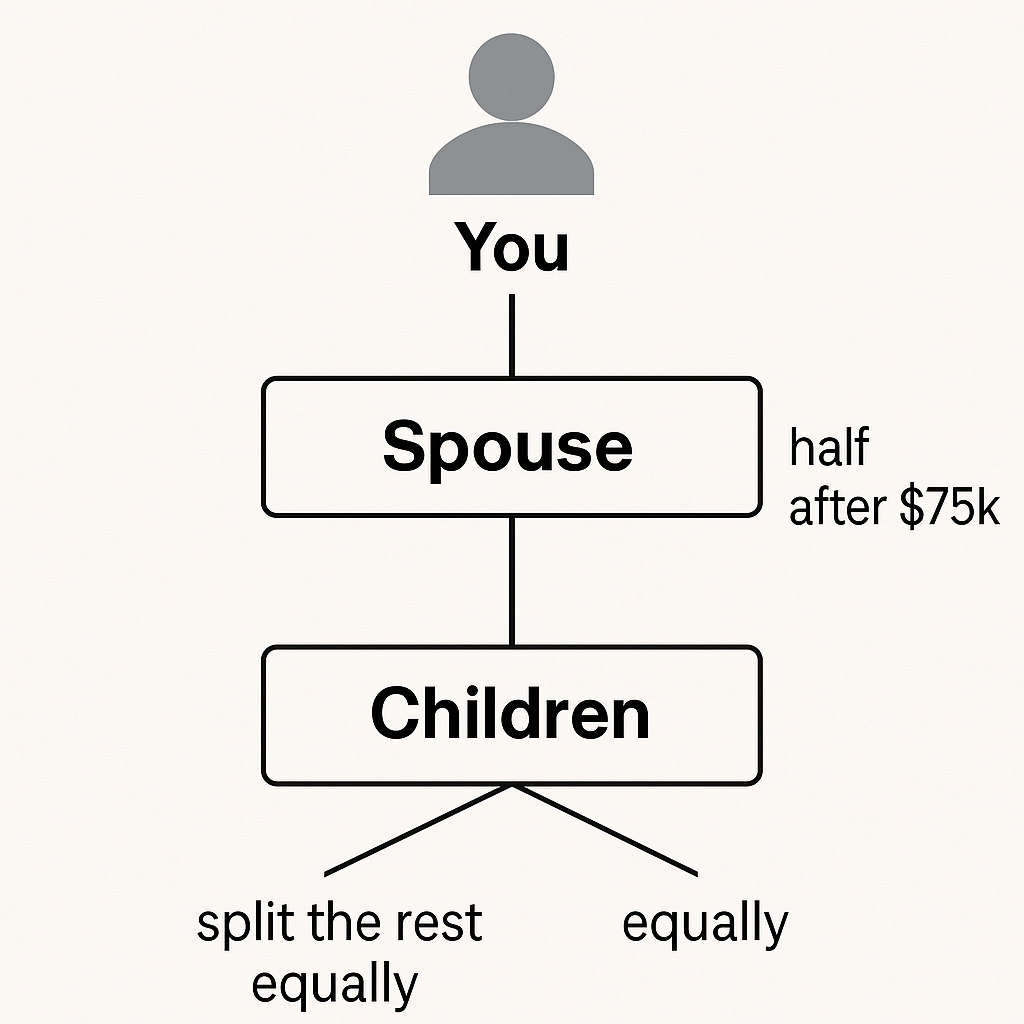

With children from another relationship:

Your spouse inherits the first $75,000 plus half of the remaining estate. The rest goes equally to your children from all relationships.

Example diagram:

No children:

Your spouse inherits everything unless your parents are still living. Then your spouse gets the first $75,000 plus half of what’s left, and your parents share the remainder.

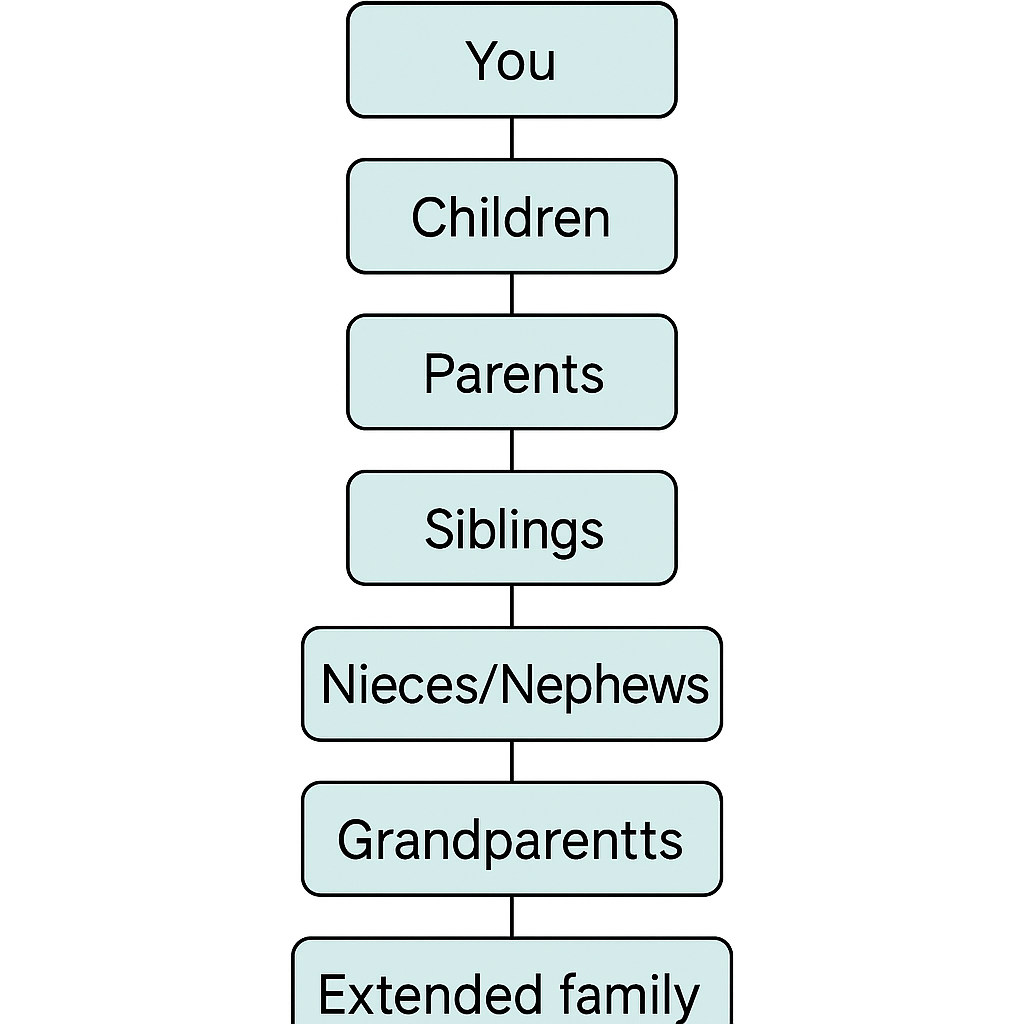

If You’re Not Married

If you die single (never married, divorced, or widowed), your children inherit everything equally.

If you have no children, your parents inherit everything.

If no parents survive you, it passes to your siblings, and if they have passed, to their children (your nieces and nephews).

Simplified flow:

What About Stepchildren or Unadopted Kids?

Stepchildren don’t automatically inherit under Utah intestacy law unless you legally adopted them. To include them, you must name them in a valid will or trust. Otherwise, they are not considered “legal heirs.”

Real Utah Examples

- Example 1 – Married, no kids: Spouse gets everything.

- Example 2 – Married, two kids (same spouse): Spouse gets everything.

- Example 3 – Married, one child from a prior marriage: The spouse gets the first $75,000 plus half of what’s left; the child gets the other half.

- Example 4 – Single, no kids, parents deceased: Estate goes to siblings. If no siblings, nieces and nephews.

- Example 5 – No living relatives: If no qualified heirs are found, the estate escheats to the State of Utah.

How Property Transfers Without a Will

Even without a will, some property skips probate automatically if ownership is structured properly:

- Joint tenancy with right of survivorship – passes to the surviving owner.

- Payable-on-death accounts (POD) – go directly to named beneficiaries.

- Transfer-on-death deeds (TODD) – transfer real estate directly to heirs when you die.

If these tools aren’t set up, the probate court uses Utah’s intestacy formula to distribute what’s left.

How to Prevent Confusion (and Conflict)

To avoid probate delays or disputes:

- Write a valid will or living trust.

- Name beneficiaries on your bank accounts and property deeds.

- Talk with your family so everyone knows your wishes.

- Update documents after marriage, divorce, or new children.

- Get legal advice if your family situation is complex.

Simple diagram summary

Utah Intestacy Video and Post Hub

YouTube Resources

Conclusion

Understanding who inherits your property in Utah without a will helps you plan wisely, but it is better to decide for yourself than leave it to state law.

Writing a simple will or setting up a trust gives you control, saves your family time, and reduces conflict.

For more plain-English legal guidance, stay updated with Utah Law Explained, explore our mission on the About Us page, or connect with trusted counsel like Gibb Law Firm.