How Do Utah Transfer-on-Death (Beneficiary) Deeds Work?

Plain-English guide to eligibility, drafting, recording, conflicts, and common mistakes

A Utah transfer-on-death deed lets your home skip probate and pass directly to a named beneficiary, if it is drafted, notarized, and recorded correctly. This guide explains who can use one, the exact language Utah expects, how to record or revoke it, and the traps that can derail your plan.

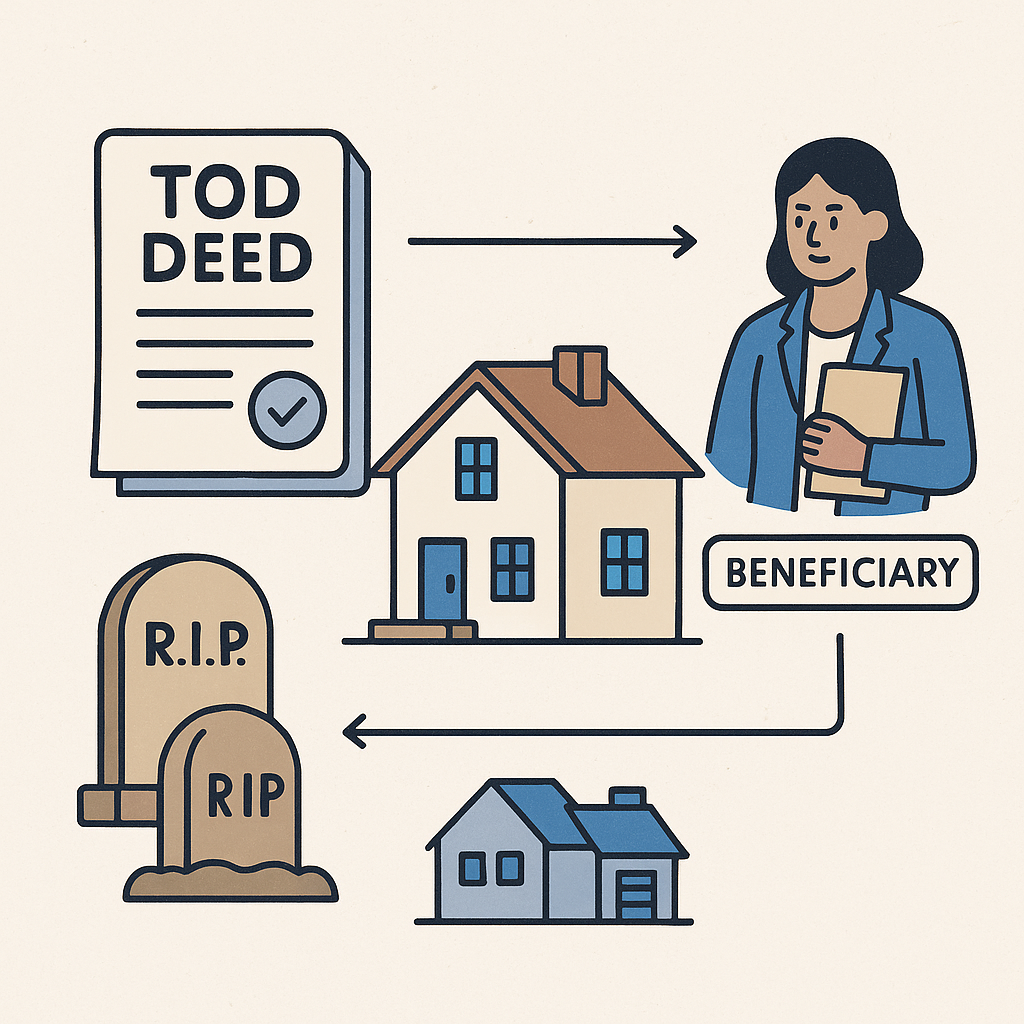

What a TOD Deed Does

A transfer-on-death deed names a beneficiary to receive your Utah real estate at your death, similar to naming a beneficiary on a bank account. Until you pass away, you keep full control. You can sell, refinance, or revoke the deed at any time. When you die, ownership automatically transfers to the beneficiary without Utah probate court.

This can save time and money for your family, but it is not a cure-all. A TOD deed does not erase mortgages, liens, or debts. Those still attach to the property and can affect your beneficiary after transfer.

Who Can Use It and Limits

Any Utah homeowner can record a TOD deed for property they own in their name alone or as joint tenants with rights of survivorship. If there are multiple owners, each must agree and sign.

A TOD deed cannot override community property interests or an existing trust. The beneficiary must outlive you to receive the property. If the beneficiary dies first, the deed is typically void and the home falls back into your estate unless you recorded a new deed.

Drafting Essentials and Notarization

Utah expects clear, specific language for a valid TOD deed. Be sure the document includes:

Recording and Revoking

A TOD deed takes effect only if it is recorded with the county recorder where the property is located before the owner’s death. Keeping a signed deed at home is not enough.

You can revoke at any time by recording a revocation or by recording a new TOD deed that replaces the old one.

Conflicts With Wills and Trusts

For the specific property covered, a TOD deed generally controls over your will. If your will names one heir but the TOD deed names another, the deed usually wins.

Do not use a TOD deed for property already titled in a living trust. Mixing both can create conflicting chains of title and headaches for your beneficiary. Review your full estate plan so deeds, wills, and trusts work together.

Common Mistakes

- Not recording the deed with the county

- Using an incorrect or incomplete legal description

- Failing to update after divorce, beneficiary death, or a sale

- Overlooking mortgages, HOA covenants, or existing liens

Video and Social Learning Hub

YouTube: Transfer-on-Death Deeds

Instagram: TOD Deed Highlights

Need Help Applying This to Your Situation?

A Utah transfer-on-death deed can simplify passing down your home, but only if it fits your larger plan and is recorded correctly. Consider how it interacts with your will, any trust, your mortgage, and your overall goals.

Talk to a Utah AttorneyFor more plain-English legal guidance, stay updated with Utah Law Explained, explore our mission on the About Us page, or connect with trusted counsel like Gibb Law Firm.