What are Utah wage garnishment limits and exemptions?

Plain-English guide to how garnishment starts, the 25 percent cap and 30x rule, exempt income, and how to claim protections

If you have been hit with a wage garnishment notice, you are not alone. Thousands of Utahns deal with this every year, often without realizing they have rights under state and federal law. Bottom line: you can keep more of your paycheck than most people think. This guide explains how garnishment starts, how much creditors can take, what income is off-limits, and how to file exemptions.

How Wage Garnishment Starts

A creditor cannot take money from your paycheck overnight. In Utah, wage garnishment usually begins after the creditor gets a court judgment. With a judgment in hand, the creditor can ask the court for a Writ of Garnishment. Your employer must follow the writ and withhold part of your paycheck until the debt is paid or the garnishment expires.

You should receive notice before this happens. The packet typically includes a copy of the writ and information on your rights, including how to claim exemptions or challenge the amount withheld.

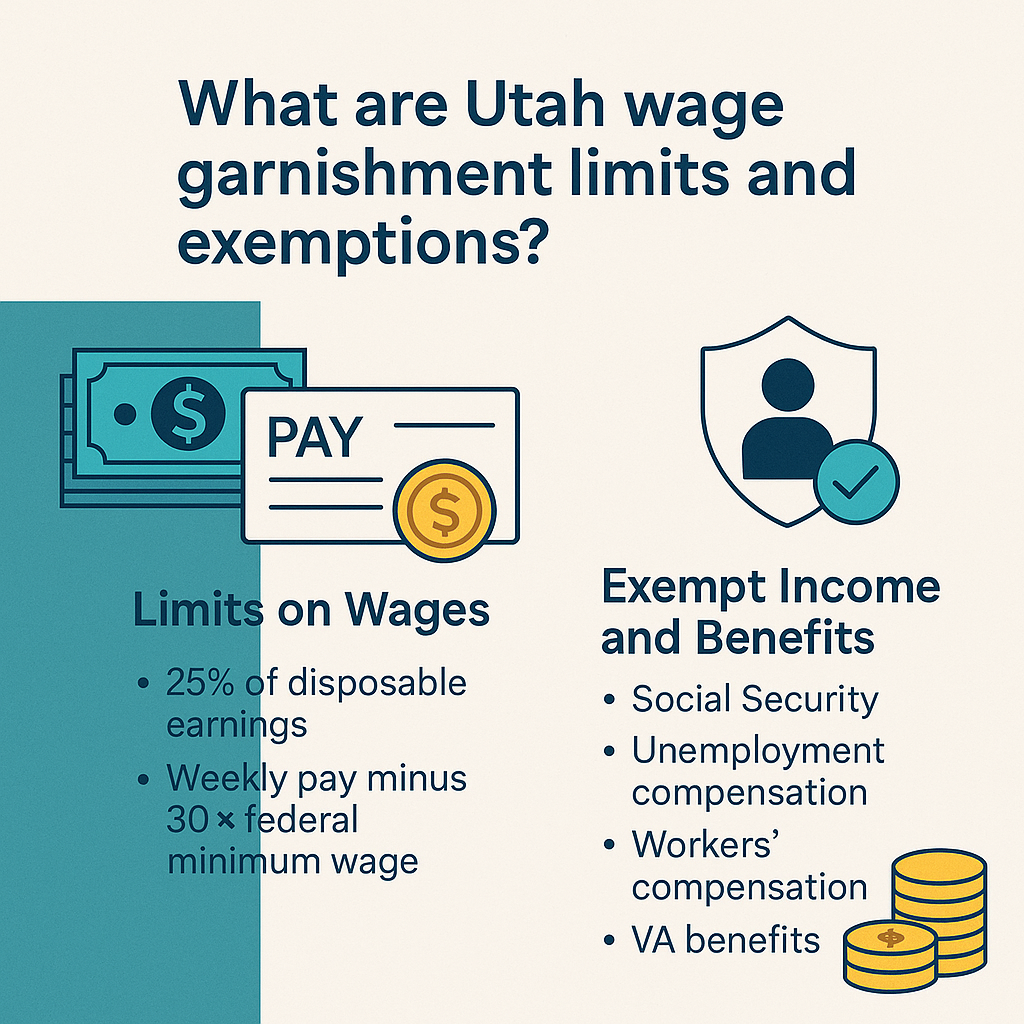

Limits on Wages

Under federal law, a creditor may garnish the lesser of 25 percent of your disposable earnings, or the amount by which your weekly pay exceeds 30 times the federal minimum wage. Utah follows this federal standard. Some debts, like child support, alimony, or taxes, can legally exceed those limits.

Exempt Income and Benefits

Certain income sources are completely exempt from garnishment in Utah. Creditors cannot take the following:

These funds remain protected after deposit, but it is best to keep them in a separate account. If your paycheck mixes exempt and non-exempt funds, a bank may freeze the account until you prove what is exempt. File a claim for exemption quickly to protect those funds.

How to Claim Exemptions in Utah

When you receive a Writ of Garnishment, it should include an Exemption Claim Form. Use it to protect exempt income or to ask for a reduction.

- Complete the form accurately and list the exempt income.

- Attach proof, such as bank statements showing Social Security deposits.

- File with the court that issued the writ within the deadline (usually 10 business days).

- Send copies to the creditor and your employer.

If your claim is valid, the court will order the garnishment stopped or reduced.

Stopping or Reducing a Garnishment

- Negotiate a payment plan directly with the creditor.

- Consider bankruptcy if the debt load is overwhelming. Filing usually pauses most garnishments.

- File a motion to quash if the writ was improper or exceeds legal limits.

Talk with a Utah attorney if you believe too much is being taken or if multiple debts are involved.

After-Judgment Strategies

- Review your credit report to confirm the debt shows as satisfied.

- Keep records of all garnishment payments.

- Explore Utah Clean Slate or other debt relief programs if you qualify.

Video & Social Learning Hub

YouTube: Wage Garnishment Explained

Need Help Protecting Your Paycheck?

Utah law can protect a real share of your wages. The key is speed: read the notice, file exemptions on time, and keep proof of exempt funds. This page is educational information only, not legal advice.

Talk to a Utah AttorneyFor more plain-English legal guidance, stay updated with Utah Law Explained, explore our mission on the About Us page, or connect with trusted counsel like Gibb Law Firm.